Blog

A collection of articles, stories, tips and tools designed to keep you informed about the Mortgage market.

The 5 big benefits of Property Investing

Rental property is a popular and profitable form of investment. Buying the right investment property can provide strong capital gains and regular income, while being able to leverage real estate...

How to get a mortgage when you are Self-Employed

There’s a lot to be said for working for yourself. Whether you’re a freelancer, contractor, or small business owner, striking out on your own offers a sense of opportunity that’s hard to find in...

Government Housing policy changes – March 2021

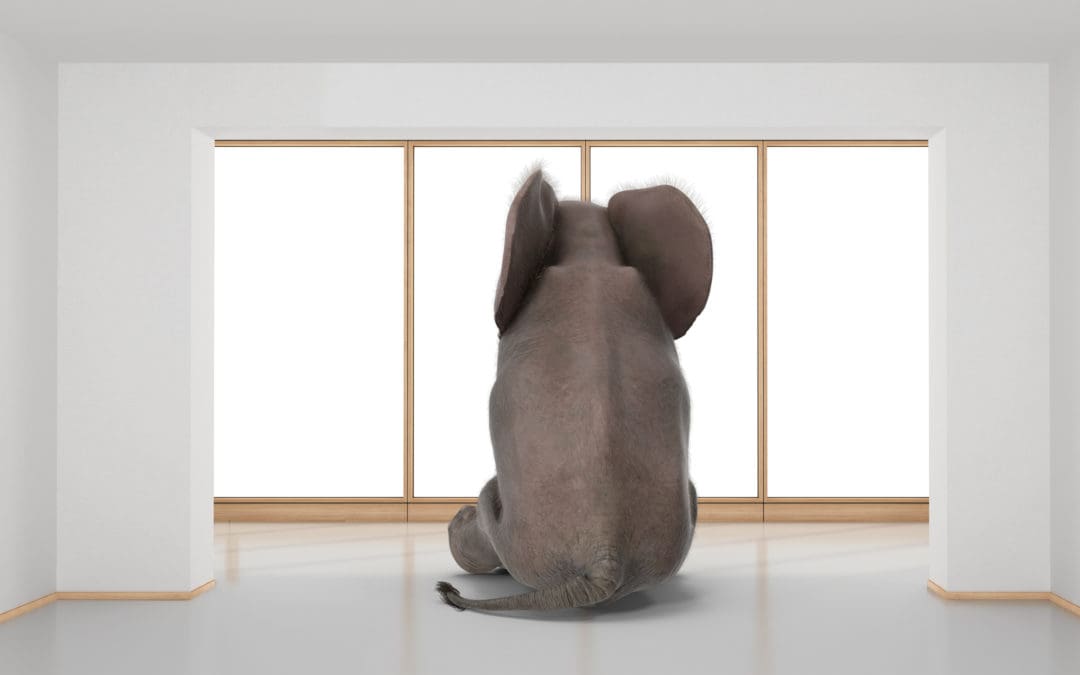

Can they work or is there ‘an elephant in the room’? A lot of comment has been made around the Government’s changes to Residential Property Investment over the last few days, so I thought commentary...

What kind of loans can I get with bad credit?

A few financial slip-ups in the past can have a surprisingly big impact on your credit rating. A bad credit rating indicates that you may be a risky borrower, which can make it difficult to get the...

LVR changes and what do they mean for you?

Background In 2013 the Reserve Bank introduced LVR restrictions to curb a potential overheating of the property market. As a rule, owner occupiers needed a 20% deposit and investors 40%, later...

Getting a home loan: What to do when the bank says “No”

It’s easy to feel discouraged when a bank rejects your home loan application, but it’s important that you do have other options when it comes to securing a mortgage. Non-bank lending can be an...

Credit searches – What to know before you apply for a Mortgage or Loan

All Lenders use a credit search as part of their assessment of a Mortgage or Loan Application and there are some things that are important to know. Some Lenders use a credit scoring system, some...

More Reasons To Be Cheerful

Upturn in House Prices… A couple of the major Banks are predicting house prices to increase by up to 7 per cent next year with the property market due to "spring back to life". This is a welcomed...

Best mortgage rates, 10% deposit owner occupied and 20% rental purchase, self employed with no financials and help for those with bad credit or arrears.

Hundreds of reviews on TradeMe and Google makes us your ‘Number 1’ choice.