It’s currently a struggle for every New Zealander: trying to get the bank to approve their home loan. Lending restrictions are tighter than ever, even for New Zealanders with a perfect credit...

A collection of articles, stories, tips and tools designed to keep you informed about the Mortgage market.

It’s currently a struggle for every New Zealander: trying to get the bank to approve their home loan. Lending restrictions are tighter than ever, even for New Zealanders with a perfect credit...

The New Zealand housing market has experienced some major ups and downs in recent months due to some interesting regulatory changes as well as wider global economic conditions. House prices...

There's a lot in the press about house prices and which way they will go. What's not said (because it's not 'newsworthy') is that we've been here before and thrived. House prices always go up over...

There’s a lot to be said for working for yourself. Whether you’re a freelancer, contractor, or small business owner, striking out on your own offers a sense of opportunity that’s hard to find in...

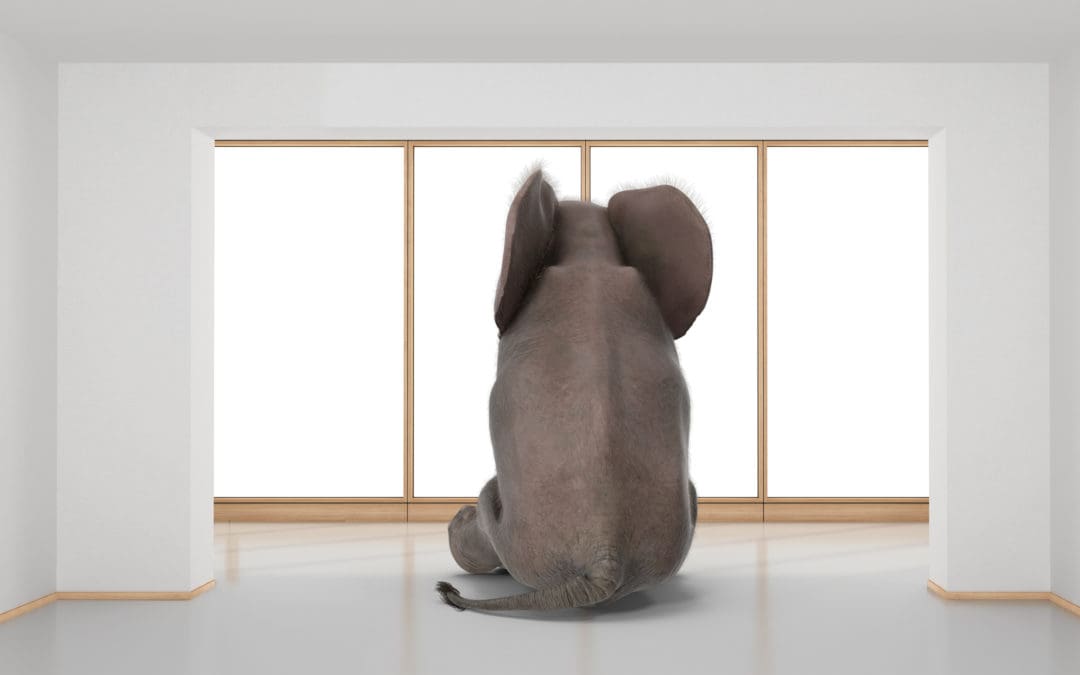

Can they work or is there ‘an elephant in the room’? A lot of comment has been made around the Government’s changes to Residential Property Investment over the last few days, so I thought commentary...

A few financial slip-ups in the past can have a surprisingly big impact on your credit rating. A bad credit rating indicates that you may be a risky borrower, which can make it difficult to get the...

It’s easy to feel discouraged when a bank rejects your home loan application, but it’s important that you do have other options when it comes to securing a mortgage. Non-bank lending can be an...

All Lenders use a credit search as part of their assessment of a Mortgage or Loan Application and there are some things that are important to know. Some Lenders use a credit scoring system, some...

Best mortgage rates, 10% deposit owner occupied and 20% rental purchase, self employed with no financials and help for those with bad credit or arrears.

Hundreds of reviews on TradeMe and Google makes us your ‘Number 1’ choice.