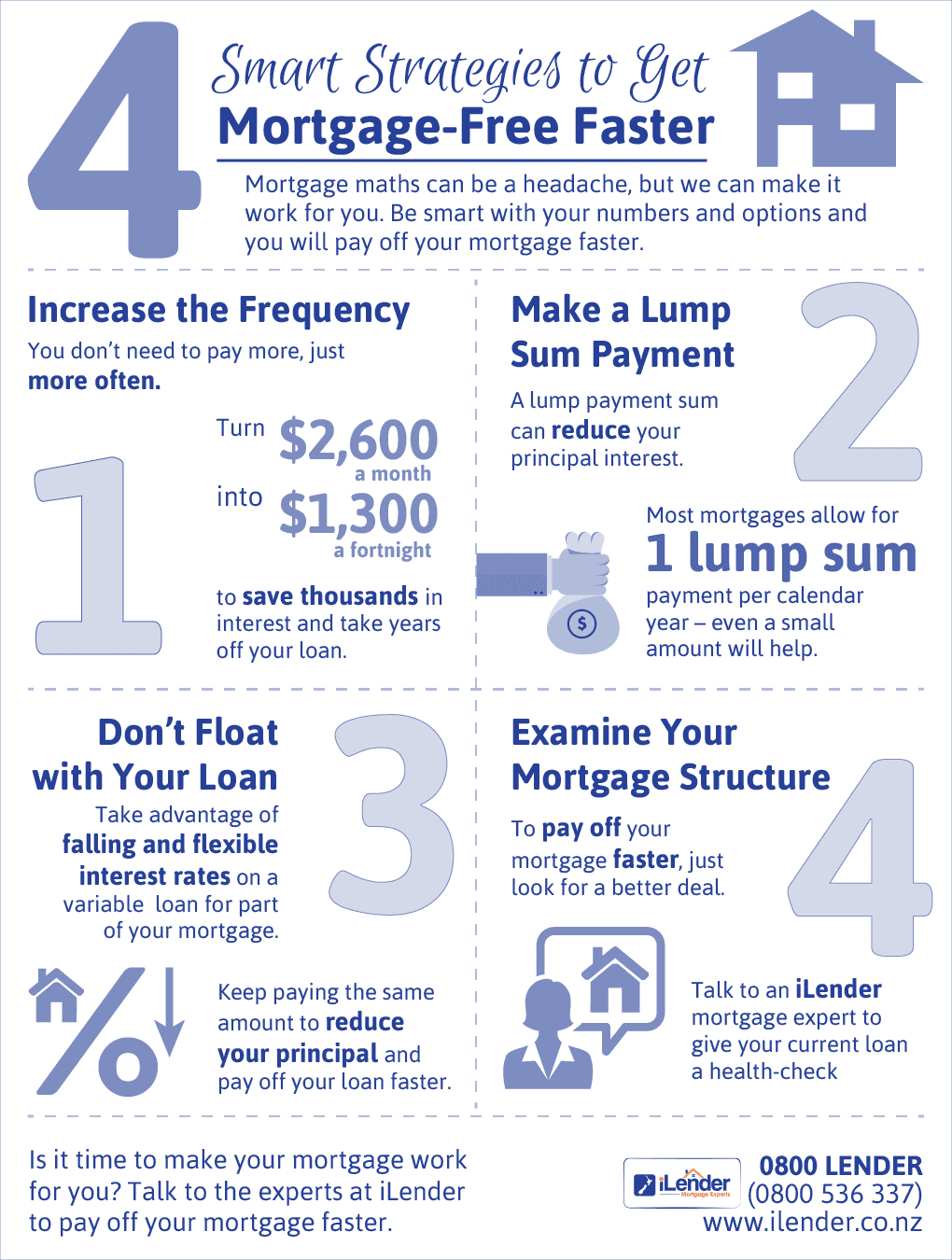

Four Smart Strategies to Get Mortgage-Free Faster

About iLender

At iLender we put your best interests first and not the Bank – our advice is unbiased as all Lenders who we do business with pay about the same in commissions.

Although we are Auckland based Mortgage Brokers, we help customers everywhere in New Zealand and overseas with buying property in New Zealand, as we are very much about online and giving advice here and now!

Best mortgage rates, 10% deposit owner occupied and 20% rental purchase, self employed with no financials and help for those with bad credit or arrears.

Hundreds of reviews on TradeMe and Google makes us your ‘Number 1’ choice.